CAPM: theory, advantages, and disadvantages | F9 Financial Management | ACCA Qualification | Students | ACCA Global

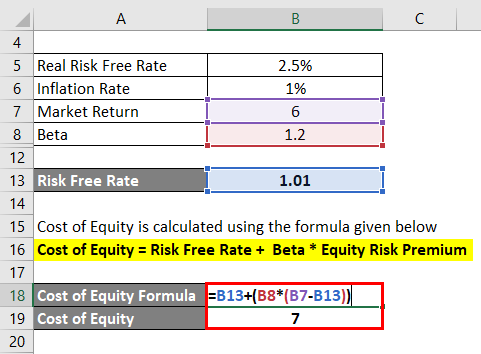

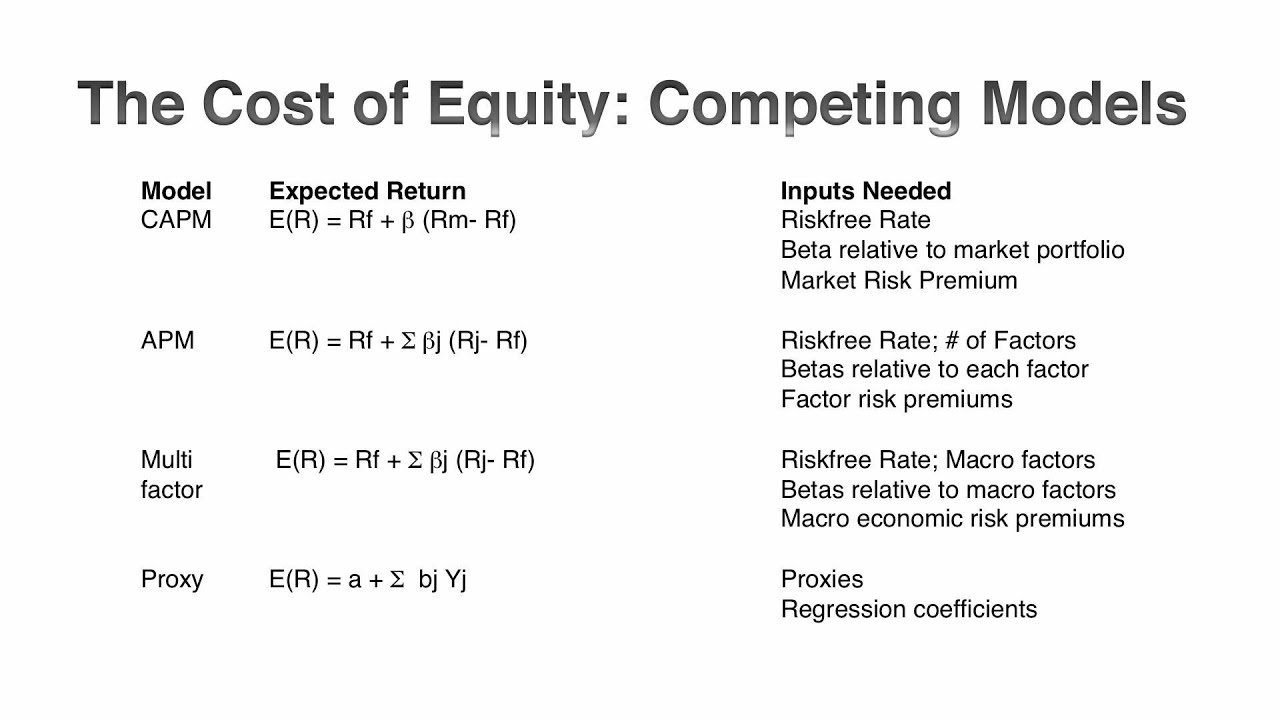

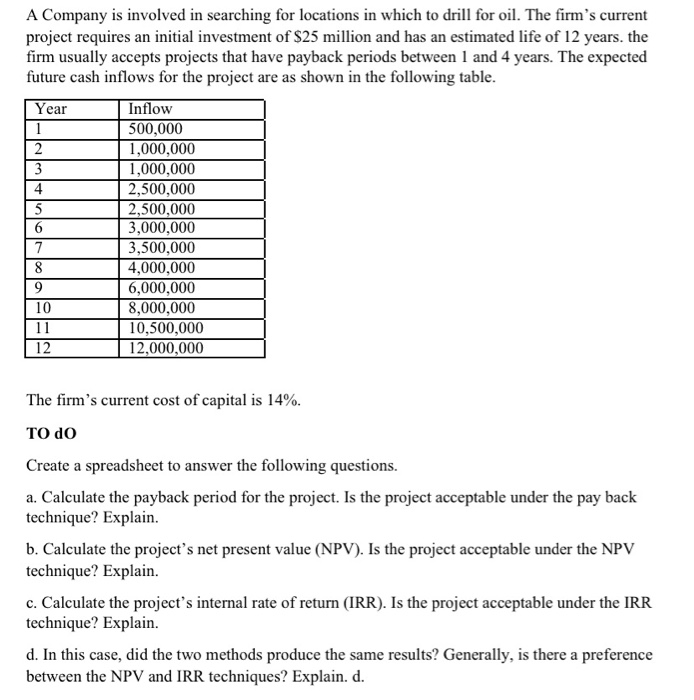

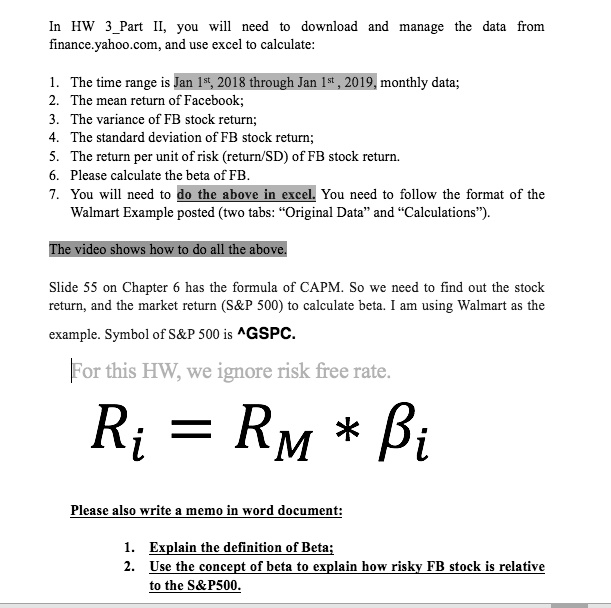

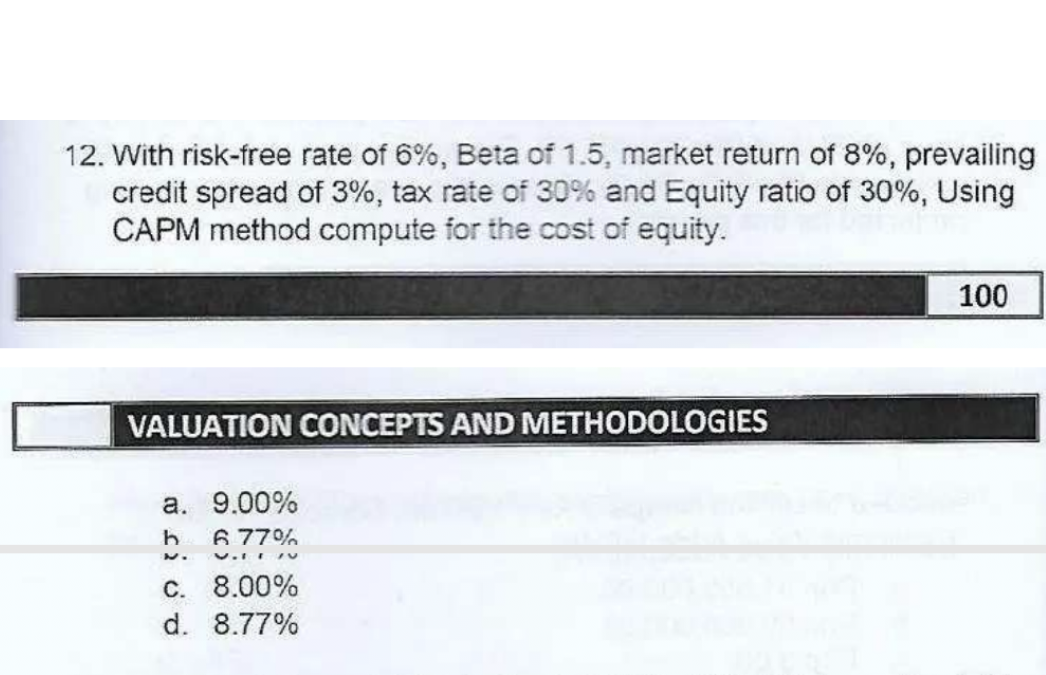

SOLVED: It says to ignore risk free rate. You can charge me for more questions if you need to. Sorry that it is such a long question! In HW 3 Part II,

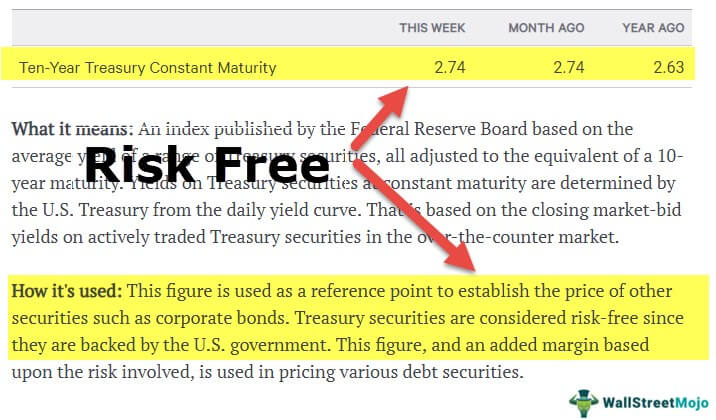

:max_bytes(150000):strip_icc()/dotdash_Final_How_Risk_Free_Is_the_Risk_Free_Rate_of_Return_Feb_2020-96f00395de3d40668f31522801756339.jpg)

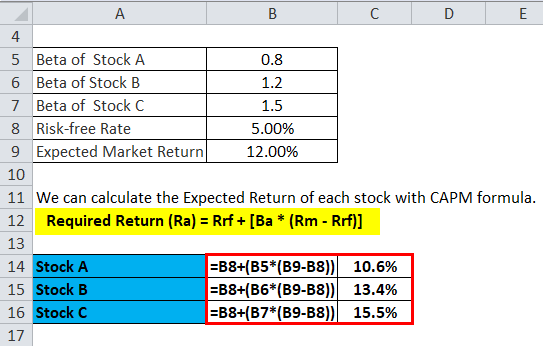

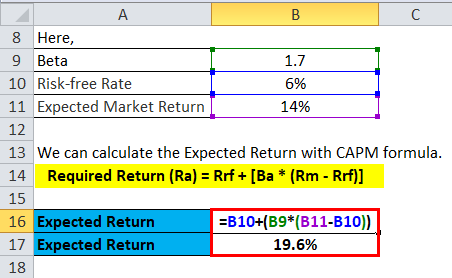

:max_bytes(150000):strip_icc()/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)

:max_bytes(150000):strip_icc()/tesla-b2b7e254720442248700b97e303b201d.jpg)