.png)

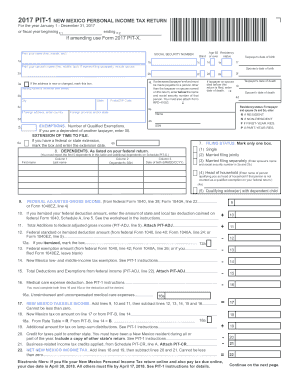

Vietnam: What are the instructions for filling out the declaration form for PIT finalization in Vietnam - Form No. 05/QTT-TNCN? What does the PIT finalization dossier include?

Where shall the resident individual who earns salary from more than one sources submit tax finalization in Vietnam?

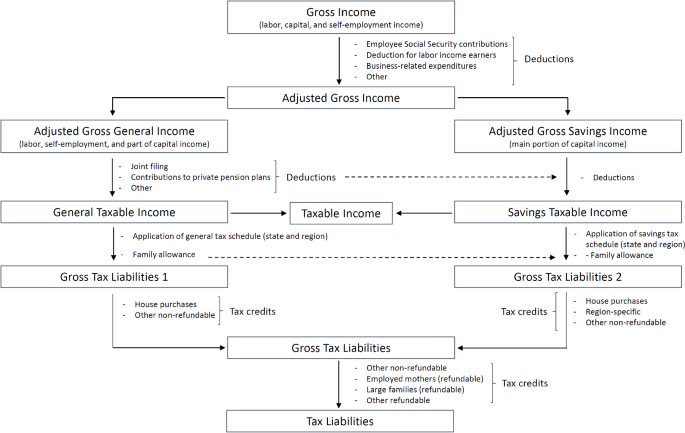

Republic of Armenia: Technical Assistance Report on Personal Income Tax: Policy Review and Introduction of a Universal Declaration in: IMF Staff Country Reports Volume 2023 Issue 060 (2023)

Vietnam: New conditions for quarterly declaration of VAT and personal income tax applied from December 05

Vietnam: Is it permissible to authorize other individuals to carry out procedures for refund of overpaid personal income tax regarding income from salaries and remunerations?

Vietnam: PIT finalization declaration form (Form No. 05/QTT-TNCN) applicable to the latest salary and